Defining the Codes needed for the

Oregon Form

OQ

The codes and examples below depict the proper setup

for an Oregon Company who has employees in the Lane transit district

as well as the TriMet transit district. These examples are based on

the Profession version of the CCS Payroll. If you are using an Express

version, then some limitations are imposed on setting up these codes.

Please see the Setting up for the Oregon OQ form

using the CCS Payroll Express: (below).

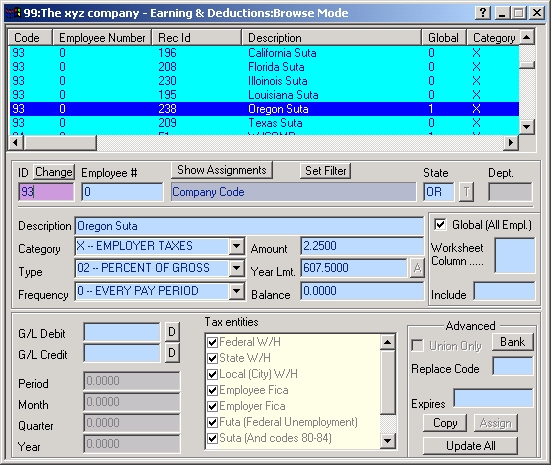

Company Level Code defining the Oregon SUTA Tax (Percentage

Based)

If your company will pay SUTA taxes to any other state

other than Oregon, then do not click the Global check box. Please see

Multi-state Companies for further

information.

|

Field

|

Value

|

Comments

|

|

ID

|

93

|

SUTA taxes must use code

93 |

| Table |

OR |

If using a Pro. Version of

CCS, then 1st enable the multi-state mode (Company

Dialog), then enter "OR" in the Table field. If you

are using an Express Version of the program, this field is not available,

and is assumed to be the state for which this Company resides. |

| Description |

Oregon SUTA |

Any applicable description |

| Category |

X

|

Employer Tax |

| Type |

02

|

Percentage of gross. |

| Frequency |

0

|

Every Pay Period |

| Amount |

2.25

|

Enter your experience rate here. |

| Limit |

607.50 |

The program will automatically calculate this value

for you based on your experience rate. It is determined by multiplying

the Taxable base wage limit ($27,000 for 2005) * the value you entered

in the amount field (2.25 %) |

| Balance |

0.00 |

Not required for a tax type code. |

| Tax Entities |

All checked |

This Code is not a pretax deduction. |

| Global |

Checked |

This check box is generally checked, unless

you will be paying SUTA taxes to more than one state. See Multi-state

Companies for more information. |

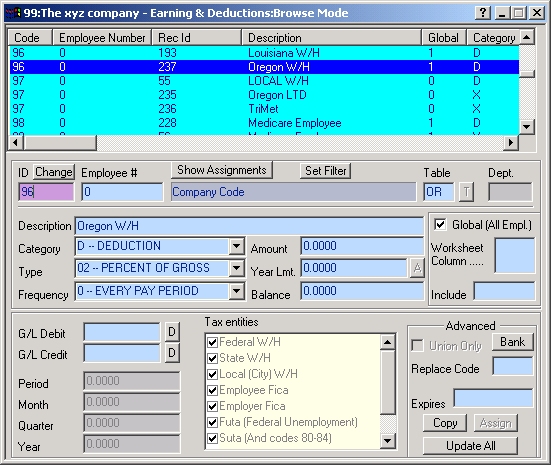

Company Level Code defining the Oregon Employee Withholding

(Table Based)

If your company will pay W/H taxes to any other state

other than Oregon, then please see Multi-state

Companies for further information.

|

Field

|

Value

|

Comments

|

|

ID

|

96

|

State W/H taxes must use

code 96 |

| Table |

OR |

If using a Pro. Version of

CCS, then 1st enable the multi-state mode (Company

Dialog), then enter "OR" in the Table field. If you

are using an Express Version of the program, this field is not available.

Please see the notes on using the Express version on the bottom

of this page. |

| Description |

Oregon W/H |

Any applicable description |

| Category |

D

|

Employee Deduction |

| Type |

02

|

Percentage of gross. If a W/H tax (codes 95,96 or

97) has a zero amount, then the tax will be calculated based on

the applicable Federal, State or Local tax table. |

| Frequency |

0

|

Every Pay Period |

| Amount |

0.00

|

If a W/H tax (codes 95,96 or 97) has a zero amount,

then the tax will be calculated based on the applicable Federal,

State or Local tax table. |

| Limit |

0.00 |

There is no maximum for this tax. |

| Balance |

0.00 |

Not required for a tax type code. |

| Tax Entities |

All checked |

This Code is not a pretax deduction. |

| Global |

Checked |

This check box is generally checked. See

Multi-state Companies for more

information. |

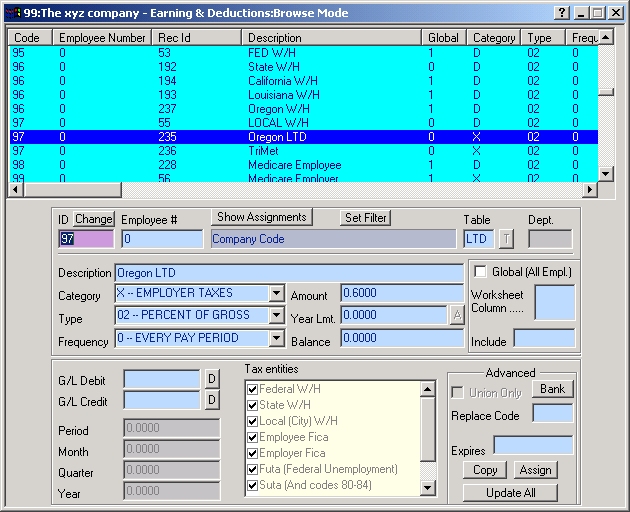

Company Level Code defining the Oregon Lane Transit District Tax.

|

Field

|

Value

|

Comments

|

|

ID

|

97

|

Local taxes must use Code

97 |

| Table |

LTD |

If using a Pro. Version of

CCS, then 1st enable the multi-state mode (Company

Dialog), then enter "LTD" in the Table field. (You

will be asked if you wish to create this Local table, choose "YES"

then complete the top line only of the tax table dialog.

No tax bracket amounts are necessary, since the calculation is based

on a strait percentage of the gross. -- See the tax table example

below) If you are using an Express version of the program, this

field is not available. |

| Description |

Oregon LTD |

The letters LTD

are required. Any other additional text is optional. |

| Category |

X

|

Employer Tax |

| Type |

02

|

Percentage of Gross |

| Frequency |

0

|

Every Pay Period |

| Amount |

.60

|

Enter the applicable percentage (.6 % equals .006)

|

| Limit |

0.00 |

There is no maximum for this assessment. |

| Balance |

0.00 |

Not required for a tax type code. |

| Tax Entities |

All checked |

This Code is not a pretax deduction. |

| Global |

Unchecked. |

Generally, you will assign this code only to employee's

who work in the LTD area. |

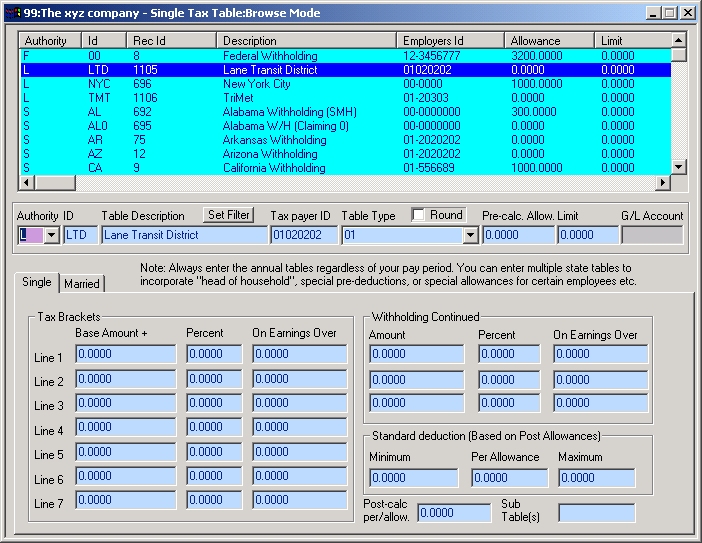

Proper setup for the Lane Transit district Local Tax table. Note that

the Authority is set to "L" and the ID is "LTD".

No tax brackets have been entered, since the calculations will be based

on the amount field you enter in the corresponding Deduction code (97).

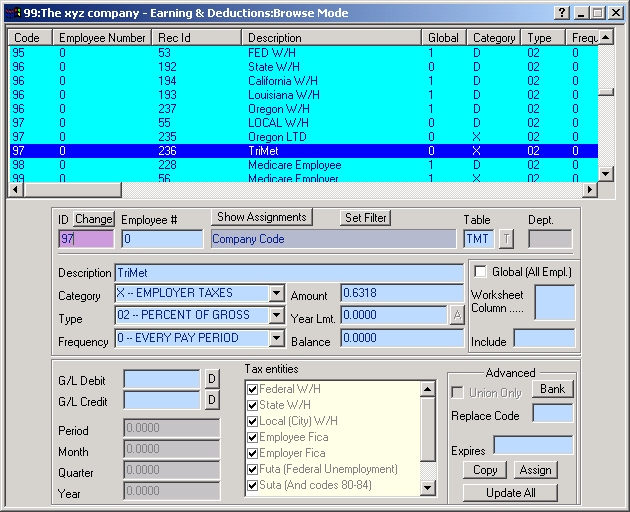

Company Level Code defining the Oregon Tri Met Transit District Tax.

The XYZ Company sets up TriMet code as follows:

- The tax rate is .006318 (.6318 %) for 2005.

One Company Level Codes are required to automate the tax

as detailed above.

|

Field

|

Value

|

Comments

|

|

ID

|

97

|

Local taxes must use Code

97 |

| Table |

TMT |

If using a Pro. Version of

CCS, then 1st enable the multi-state mode (Company

Dialog), then enter "TMT" in the Table field. (You

will be asked if you wish to create this Local table, choose "YES"

then complete the top line only of the tax table dialog.

No tax bracket amounts are necessary, since the calculation is based

on a strait percentage of the gross. -- See the example below) If

you are using an Express version of the program, this field is not

available. |

| Description |

Oregon TriMet |

The letters TriMet

or TMT are required. Any other additional text is optional. |

| Category |

X

|

Employer Tax |

| Type |

02

|

Percentage of Gross |

| Frequency |

0

|

Every Pay Period |

| Amount |

.6318

|

Enter the applicable percentage (.6318 % equals .006318)

|

| Limit |

0.00 |

There is no maximum for this assessment. |

| Balance |

0.00 |

Not required for a tax type code. |

| Tax Entities |

All checked |

This Code is not a pretax deduction. |

| Global |

Unchecked. |

Generally, you will assign this code only to employee's

who work in the Tri Met area. |

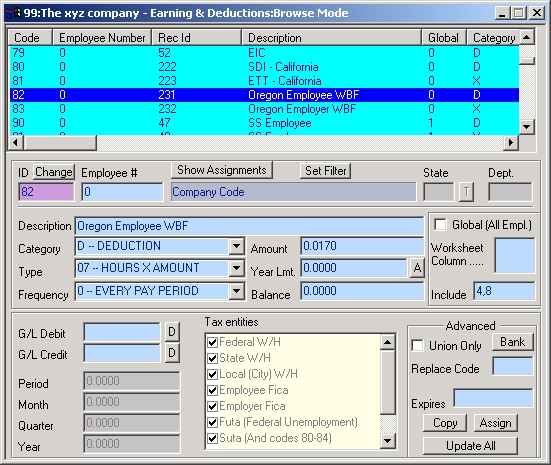

Company Level Code defining the Oregon Workers Benefit

Fund. (Hours Based)

(Employee's portion)

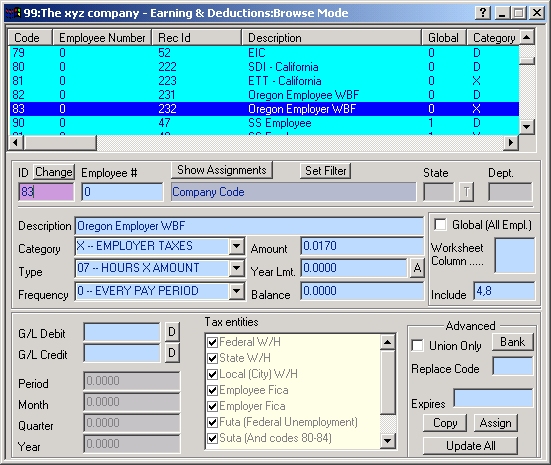

Company Level Code defining the Oregon Workers Benefit

Fund. (Hours Based)

(Employer's portion)

The XYZ Company sets up WBF codes as follows:

- The hourly rate is 3.4 cents (2005), split between the employee

and employer.

Two Company Level Codes are required to automate the tax

as detailed above.

Lets examine it in detail.

|

Field

|

Value

|

Comments

|

|

ID

|

82

|

The number assigned to this

Code is determined by the user who created it. The only limitation

is that they be between 80 and 89 due to the fact that these codes

have been especially set up in CCS Payroll for State and Local taxes. |

| Description |

Oregon Employee WBF |

The letters WBF

are required. Any other additional text is optional. |

| Category |

D

|

Employee Deduction |

| Type |

07

|

Hours times Amount |

| Frequency |

0

|

Every Pay Period |

| Amount |

.017

|

Enter the applicable hourly amount (1.7 cents for

2005) |

| Limit |

0.00 |

There is no maximum for this assessment. |

| Balance |

0.00 |

Not required for a tax type code. |

| Tax Entities |

All checked |

This Code is not a pretax deduction. |

| Global |

Checked/Unchecked. |

Check this if all employee's of the company work in

Oregon and are liable for this tax, otherwise assign this code individually

to each employee as needed. |

|

Field

|

Value

|

Comments

|

|

ID

|

83

|

The number assigned to this

Code is determined by the user who created it. The only limitation

is that they be between 80 and 89 due to the fact that these codes

have been especially set up in CCS Payroll for State and Local taxes. |

| Description |

Oregon Employer WBF |

The letters WBF

are required. Any other additional text is optional. |

| Category |

X

|

Employer Tax |

| Type |

07

|

Hours times Amount |

| Frequency |

0

|

Every Pay Period |

| Amount |

.017

|

Enter the applicable hourly amount (1.7 cents for

2005) |

| Limit |

0.00 |

There is no maximum for this assessment. |

| Balance |

0.00 |

Not required for a tax type code. |

| Tax Entities |

All checked |

This Code is not a pretax deduction. |

| Global |

Checked/Unchecked. |

Check this if all employee's of the company work in

Oregon and are liable for this tax, otherwise assign this code individually

to each employee as needed. |

If you wish to make the payment of these taxes via the

CCS Payroll Program, add the necessary banking information by clicking

on the Bank button for each of the above codes. Remember to click the

"Show Address" checkbox and fill in the agency name & address

if you will be paying with a paper check. Also click on the Multiple

Weeks checkbox unless you want each pay period's line item listed separately

on the check stub.

Setting up for the Oregon OQ

form using the CCS Payroll Express:

The CCS Payroll Express is not capable of having more

than one Company level code for any single tax. For example, only one

Company level code 96 (State W/H) code can be defined, therefor it is

not possible to disburse or report the taxes for more than one state.

This limitation; however, does not prevent multi-state or multi-location

employees from being properly taxed during paycheck generation via the

Express version, since the State and Local tax assignments in the Employee

dialog (rates tab), determines which state and locality an employee

is to be taxed. The Express version is capable of proper taxation of

multiple states and localities as long as no single employee is to be

taxed in more than one locality or state via any given paycheck. Many

reports; however, are still limited to the Companies default state when

reporting using the Express version. For instance, the Express version

cannot properly fill out a SUTA report for any state other than the

Companies resident state, and will not fully itemize the state and local

taxation of multiple states or localities on the Quarterly report.

Due to these limitations, it is not possible to have a

separate code 97 for TriMet and another code 97 for Lane. If your company

does not perform services in more than one of these transit districts,

the simplest way to setup the local tax, is to simply change the description

of the current code 97 (Local W/H) to, for instance "TriMet Tax".

If your company performs services in both areas, then leave the description

as it is (Local W/H) and you will have to fill out portions of the Oregon

FORM OQ Manually.

How the description is used by the reporting engine

and disbursement process.

Both the description and the "Table" are used

during reporting and disbursement of taxes to determine which state

or locality a tax belongs. When using the CCS Express, the Tax table

is stamped on a State W/H code used in a paycheck based on the employee's

State assignment in the Employee rates tab. The same holds true for

Local W/H. Therefor the same State or Local W/H code can be used across

the Company, yet represent different states or localities depending

on which employees utilize the code. Most Quarterly reports, including

the Oregon OQ form, use the "Tax Table" field to determine

which codes are applicable to the report.

The disbursements process; however, in the CCS Express,

does not differentiate one state or locality form another, unless the

description is also different. Therefor if you wish to disburse the

taxes of multiple states or localities in the CCS Payroll Express, the

description for each State or Local W/H entry on a paycheck must be

unique to that state or locality. The only way to accomplish this via

the Express version, is to create Employee Level override W/H codes

for each Employee, altering the description as necessary for each code.

The example above is for Oregon employers; however,

the CCS Payroll program has the ability to incorporate and handle any

state or local tax requirement.