Getting ready for the W-2

Part 1: Insuring your retirement plans and cafeteria plans are

properly defined.

In-order for the CCS Payroll to properly report your deferrals in

box 12a-d, (See image1) you must insure they are properly setup.

CCS Currently supports the reporting of the following

codes in box 12 of the W2: A, B, C, D, E, F, J, S, W, R, AA, BB

For a standard 401k. Simply use the category "4" for

the Employee side, and "K" for the employer side. A standard 401K

will report in box 12 with a code "D"

For other plans, the description plays an important

part in the W-2 printing process:

To set up a 403B, use Category 4 (Employee) or

K (Employer). Be sure to use "403" in the Description. (The program

looks for "403" in the Description during the printing of W-2's to

differentiate between a 401K and a 403B.) Uncheck the taxes for which

the 403B is a pretax.. A 403 prints as an "E" in box 12 of the W-2.

For a Simple Plan: Insure either

the text "408P" or "Simple" appears in the description. Use

Category 4 (Employee) or K (Employer).-- A "S" will be put

in box 12 of the W-2. A "408" in the description without the "P" or

"Simple" in the description will report on the W-2, box 12 as a "F".

Uncheck the taxes for which the Plan is a pretax.

To enter a "Roth" 401K or 403B, simply put

"Roth" (without the quotes) in the description as well.

A Roth 401K will print an "AA" in box 12, a Roth 403B will

print a "BB" in box 12.

See Setting

up various employer contributions and non-cash earnings that

need to report on the W2 for non-deferrals reporting in box 12.

CCS also is capable

of reporting both taxable and nontaxable 3rd party sick pay on the

W2. Please contact us for help in setting this up.

Cafeteria Plans:

To set up a Section 125 (Cafeteria Plan),

use Category D if paid by the employee or Category X

if paid by the employer. Be sure to use either "125" or "Cafe" (or "Cafeteria")--not case

sensitive--in the Description. Uncheck the taxes for which

the Section 125 is a pretax.

If you had these defined improperly,

simply make the necessary corrections in the Earning/Deduction code,

then press the "Update All" button on the bottom right of the E/D

form. See image 2.

We highly recommend you print a few W2/W3/1099 and

1096 early on to insure things are as they should be.

Part 2: Insuring your SS and Medicare taxes are correct.

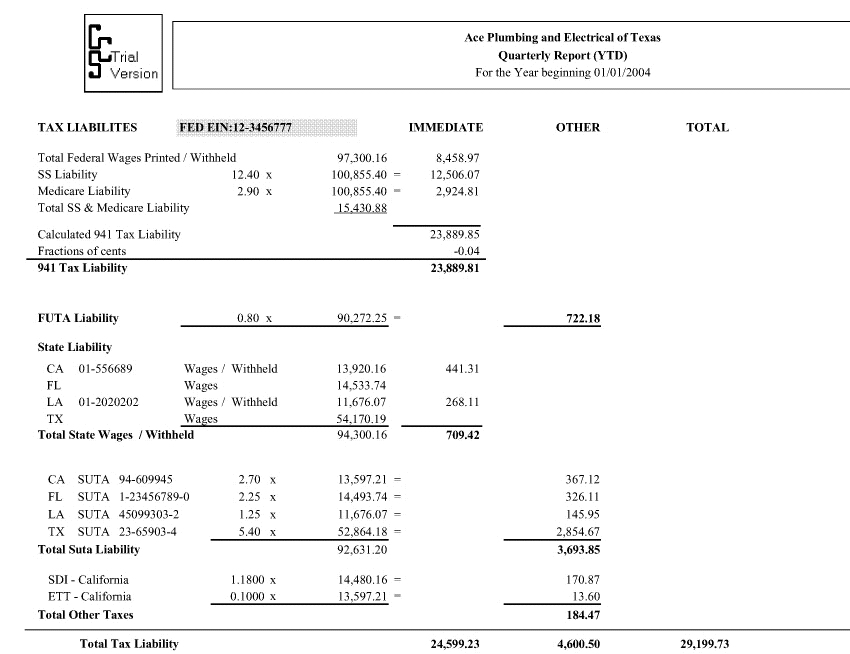

The quarterly report shown

above for the sample company Acme Plumbing and Electrical of Texas,

a multi-state employer, details all taxes due by the Employer. The

report is well balanced,

The total withholding

rounding error is 4 cents (negative) this means that the amount

withheld is 4 cent less than what is now being calculated across

the year. This is quite fine, since the

both the 941 and 943 allow for the fractions of cents. If this error

is more than .05 cents on any once paycheck, CCS will not

use the fractions of cents on the 941 or 943 and instead, recalculate

the tax liability and report the tax exactly

as calculated across the quarter or year, leaving you with a possible

balance or credit due if you paid your taxes based on the accumulated

amounts.

If you see a FICA Balancing box on

the last page of your report, (See the circled area below),

then the program has determined you have a balancing problem that

warrants your concern.

The FICA AND CO

FICA should always agree to the penny. If

you have an error here, it must be corrected or your end

of year reporting (W2's and W3's both) will be wrong. The best way

to correct this is to run a quarterly report for each quarter, to

determine which quarter the error resides. The consistency check

will alert you of this error prior to running the report and print

an error listing of those checks that have a difference between

the Employer and Employee sides. You should determine which side

is correct and make the necessary adjustments. If the error is small

you may elect to make the adjustment in the last quarter. If the

error is large, please contact us and we will help you with the

necessary adjustments.

Note: If you are using the older

Medicare Mode (with SS & Medicare combined in code 90, then

the balancing box is always present on the quarterly report, simply

verify that the values are as they should be.)

The quarterly report

also reports the wages subject to taxes by each state. You should

verify these totals to insure you have placed the taxation into

the proper state and locality.

Also note any amounts

in red on the detail area of the quarterly report. This signifies

a possible error of $1.00 or more in taxation, amounts reported

in blue indicate an error of 2 to 5 cents (or more) depending on

the column and can generally be ignored. An amount in red may not

be a problem, but should warrant your investigation.

Lastly, you should

print a W3 for each company and compare it with the YTD totals

of the quarterly report. These values should not be off by more

than the stated FICA balancing difference. All Federal, State and

Local withholdings should not be off by more than a penny or two

at most.

It is important that

all your reports agree. The 941/944 and your state Suta and W/H forms

should agree with the quarterly report for the quarter and the W3

should agree with the quarterly report of the year (YTD) as

well as any Annual State W/H forms. The many consistency checks

that run after paycheck generation and prior to reporting will always

alert you of the possible taxation errors, and if you heed these

warnings, your reports will always agree, yet the program cannot

decide for you what should and should not be taxed. You must make

these decisions yourself; so please, before you print your year

end reports, insure you have setup all pretax deductions and tax

free earnings correctly. If you change an earning or deduction tax

status mid-year, you will probably have an under or overwitholding

problem at year end. It is far better to correct these problems

before the last payroll, then have to a submit a 941c or W2c etc.

Note: It is always possible to correct the withholding or taxation

of a past payroll (current year or prior) without affecting the

net payroll (cash out), please contact us for instructions on this

procedure if you feel you need this type of an adjustment. However

the sooner you correct a problem the better!

Please let us know

if we can be of any assistance to you during your year end processing.

We are happy to help.

There are no special

closings or procedures. And yes, you can continue with the next

payroll year, and then at anytime come back and print

your prior year reports. All past data remains on file. Be

sure you are running a current version of the CCS Payroll prior

to running your year end reports.

Related Information:

Setting

up and printing 1099 forms

Setting

up various employer contributions and non-cash earnings that

need to report on the W2

See the Quarter End Procedures on your Help Menu

for further instructions on both Quarter and Yearend procedures.

Note: The 1099 and 1096 must be printed to IRS

approved preprinted forms. The W2, W3, 941, 940, 940EZ and 943 can

be printed to blank paper.